Empty Nest, Where Next?

Go backBy Cherry Maslen

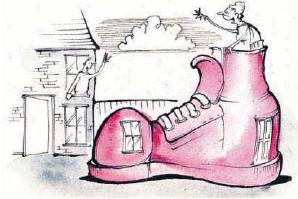

Illustrations By Russel Herneman

Published in The Sunday Times Scotland Sunday 1st December 2019.

Swap a family home for a city pad, turn a profit in your back garden — or stay put and party. Cherry Maslen reveals the new downsizing tribes.

The Lock-Up-and-Leavers

Feel like selling the family home, buying a comfortable flat with on-site security, then blowing the rest on a Mediterranean pad? You’re not alone. Property wealth means today’s over-55s are more able to afford second homes abroad than any other generation – and if they haven’t bought a villa in the Med, they’re certainly interested in exotic adventures. A survey of residents by Cognatum, a builder of upmarket homes for the over-55s, revealed that 20% expect to spend two months or more away from home every year.

Upside: Not having to be in the UK in February. Or December.

Downside: Service charges can be high.

Top tip: “Look for a lock-up-and-leave property within a strong community,” says John Lavin, managing director of Cognatum. “Properties set around squares or circles, rather than in straight lines, mean neighbours help keep your home safe.”

The Bimbys (Build In My Backyarders)

If you’ve got a big enough garden or a bit of land, you could be a Bimby and split your plot in two, building yourself a slick, ecofriendly grand design that costs little to run and selling off the faded family house for someone else to maintain. The Self and Custom Build Market Report estimates that 3.6% of self-builders created a new home this way in 2017 (the latest figures).

“More than half of our customers are in the empty-nest age group,” says Paul Newman, a director at the self- and custom-build firm Potton. “Those who ask us to build on their existing plots tend to be at the upper end of the housing market, with large properties in substantial grounds. Some have dreamt of building a home for years.”

Duncan Hayes, at the National Custom & Self Build Association, points out that people doing this are building what is unavailable on the open market. “You can only do it if you hold a lot of equity in a home and have a viable plot,” he says.

Upside: You can create your dream house by digging in your own garden.

Downside: It can be an uphill struggle getting planning permission.

Top tip: “Future-proof your new house by designing in a bathroom and bedroom on the ground floor, so you won’t have to move again when you’re older,” Newman says.

The Culture Clubbers

How about swapping the family house in the suburbs for a flat in London, Bath, Oxford or Edinburgh, where you can walk to all the cultural joys you missed while focusing on the family? Increasing numbers of the healthier, wealthier downsizer generation are attracted to the buzz of city life: data from the Office for National Statistics indicates that almost 6% more retired people moved to the capital in 2018 than in 2017.

If you don’t want big-city sprawl and crowds, there’s an abundance of galleries, theatre and music in smaller cities and festival towns such as York and Cheltenham. But if you’re thinking central London postcodes, falling prices mean now could be a good time to invest. Thamesside penthouse, anyone?

Upside: More nights at the opera.

Downside: Less space for visiting family.

Top tip: Do you really need a car? Looking for somewhere with a garage or parking narrows your property search. The increasingly popular city car clubs allow you to book a vehicle when you need one – no maintenance, no insurance, no car tax.

The Granny Annexers (or Multigenerationers)

These non-downsizers join financial forces with elderly parents to buy a multigeneration house with extra space or an annexe for them, plus enough room for boomeranging twentysomethings. If they can’t find the right property, they look for one that they can adapt or alter their own.

“The key to making this work is not just separate kitchens, but separate entrances and outside space,” says James Greenwood, of the property search firm Stacks. So, cosy garden rooms, built-on annexes, adapted outbuildings or flats on the lower ground floor – if the steps aren’t too steep. Or how about a granny garage? “A garage conversion can be a good solution for a parent moving in, as it gives a separate entrance while still being connected to the main house,” says Jeremy Wiggins, director of the architecture practice Gpad London.

Upside: Family togetherness.

Downside: Family togetherness.

Top tip: “Joan Collins once said that the secret of a happy marriage is not having to share a bathroom,” says Julian Prieto, founder of the renovation specialist Edge2. “The same applies with multigeneration households – make sure you keep your own personal space and add bathrooms for anyone joining the household.”

The Same-Sizers (Or The Up-And Downsizers)

This lot have no intention of moving anywhere smaller, some swapping an expensive postcode for somewhere they can find a house for their ever-expanding family (offspring, partners, grandchildren) to gather. Kirsty and John Beckwith moved from their six-bedroom house in Colchester, Essex, to a compact four-bedder when their two sons left home. “We weren’t in the downsized house long before we realised that it wasn’t right,” Kirsty says. “The boys came back at weekends, sometimes with their girlfriends, and we just felt cramped.”

When the couple spotted a spacious five-bedroom home that they liked at a new housing development in Tiptree, they decided the only way was upsizing.

“We moved in last December, and we’re really happy to be back in a proper family house,” Kirsty says. “Our 18-year-old daughter still lives with us, and I think our sons see it as a second home. The modern open-plan layout means it’s easy for us all to be together at weekends.”

The downsizer market is shifting, according to Marcus Evans, a director at Crest Nicholson, the developer of the Nine Acres scheme, where the Beckwiths bought. “Some want larger ‘lifetime homes’ with space for entertaining family and friends.”

Upside: Not having to get rid of half your possessions.

Downside: Your nest may never be empty.

Top tip: “It’s a mistake to move too far from your children, however idyllic the location,” says James Greenwood, of the property search company Stacks.

The Buy-To-Letters

How about downsizing and spending the freed-up cash on one or two buy-to-lets to generate retirement income, while at the same time providing a city pad to visit and for offspring to rent (at family rates) when needed? There’s potentially more fun in a holiday let if you can find a lucrative seaside bolthole. With a 56% increase in the number of people going on staycations last year, compared with 2017, you could make the most of high-season rents and lap up the benefits of a second home off-season.

Upside: Demand for rentals is high; mortgage rates are low.

Downside: From next April, landlords will lose tax relief on buy-to-let mortgages.

Top tip: Hold the suncream. The north of England and Scotland are the regions with the highest yields, according to the property portal Zoopla’s hotspots report.

The Stay-Putters

This tribe are going nowhere – it’s a case of reconfiguring the house to suit their new-found freedom. “Empty-nesters don’t always want to give up a big house,” says Jason Orme, one of the experts at the Homebuilding & Renovating Shows. “They could be looking at 20 or 30 more years to enjoy their home. They have the budget to remodel and can finally create a property to suit them.”

Turning their second sitting room into a gin bar, the patio into a covered entertainment zone and a bedroom into a dressing room suited Pauline and Mick Simpkin, from Kent. They didn’t want to leave their four-bedroom townhouse, where their two grown-up children and their partners are regular visitors. “We put in a sofa bed in the sitting room, so it doubles as a guest room,” Pauline says. In April, they built a year-round entertaining area in the garden, with a covered pergola, a corner sofa, a table and an outdoor rug. “I love it,” Pauline says. “We’ve put in a Belfast sink to chill beer and prosecco!”

Upside: No moving costs, stamp duty or estate agents, ever again.

Downside: Having the builders in again.

Top tip: Consider big windows and glazed doors: enjoy the fruits of past labours by putting your feet up and admiring the view.

For more information:

01491 821170

property@cognatum.co.uk